Everyone enjoys paying less tax on their earnings. However, there are few opportunities to do this legitimately. With the cost of living expected to rise, this desire to maximise net pay will only increase. We will need to think innovatively within the confines of the law.

With this in mind, it may be beneficial to explore the opportunities that a salary sacrifice scheme pose. This scheme was introduced by the government to incentivise particularly environmentally friendly products or services. For example, the Cycle2Work Scheme which allowed employers to purchase a bike for their employees which they then paid back through a reduction in the gross salary over the next few months. This therefore reduced their taxable pay for the year and meant that less tax was paid.

However, salary sacrifice schemes can also be used when providing employees vehicles. There is one caveat around this though, it must be electric or hybrid.

Below is how this works:

1. Employer secures a contract hire for an electric car which they then provide to their employee for both business and private use

2. Employee then pays the contract hire payments through a reduction of their gross salary, therefore reducing the taxable income

3. The employee then pays benefit in kind on their vehicle – although this is minimal due to the tax advantage of electric vehicles

4. The employer then pays class 1a national insurance on the benefit

5. At the end of the 2, 3 or 4 years lease the employer then hands the car back to the leasing company and the whole cycle can start again.

What is the administrative burden for this?

To set this up internally does require a larger amount of administrative work as there are many factors to take into consideration to ensure that this scheme is administered correctly. However, there are multiple providers that fully manage the scheme for you and ensure that all compliance is met.

What are the benefits for the employer?

A salary sacrifice can be portrayed as an attractive benefit for new staff as well as being an excellent staff retention tool. It also shows a committal to reducing companywide Co2 emissions at the same time as reducing the national insurance contributions a company must make.

How it may work for your business.

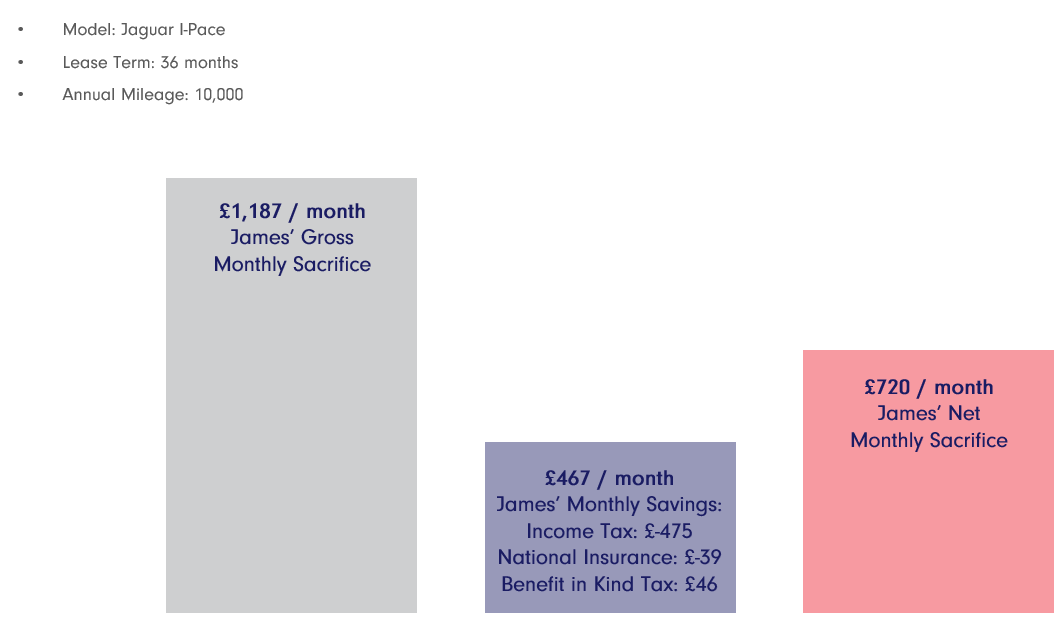

James is a 52-year-old purchasing manager at ABC Ltd. He does very few business miles and his employer wants to reward his hard work

and years of service with a quality vehicle. However, James is not keen on paying anymore tax than he has to, and his employer can see

that any car allowance he gives him, he will only take home about half of it and is only prepared to give him a monthly allowance of £800.

James is on £95,000 per annum and understands that a salary sacrifice scheme may be a good option for him.

As you can in the graphs above, James ends up sacrificing a total of £720 of his net salary each month. However, as his employer is paying an additional £800 a month in the form of a car allowance, he will be receiving a car as well as the additional unused car allowance. Overall, a very good outcome for both him and the company.

If you would like to discuss these schemes in more detail, please contact your account manager or email

[email protected] and we will be in touch.