A clear and regular statement of equity is essential for personal and business financial and tax planning and the preservation of family relationships.

ABC Enterprises Ltd is owned by Phil (60) and his sons John (35) and Tim (29). Phil started the business 30 years ago, but has handed the running of the business over to his sons and is hands-off these days.

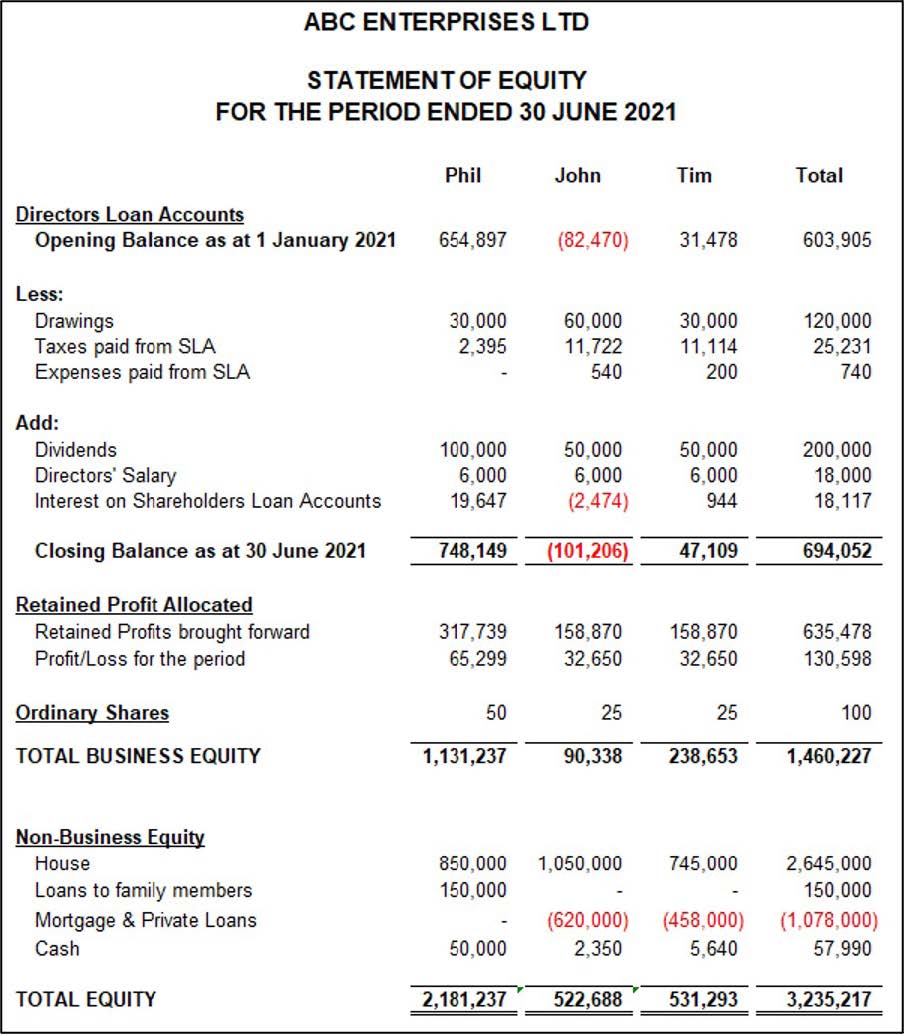

Here is an Equity Statement we produced for them, showing how the business is owned:

This statement is full of insight. Let’s unpack it and provide context to the numbers:

- Phil has a lot of equity that is exposed to Inheritance Tax. He needs to get urgent advice on how to best structure his affairs to avoid a £400k tax bill when he and his wife pass away.

- Phil has three daughters as well as his two sons, and his current will states that his estate is to be split equally between the five of them. If he were to pass away tomorrow, the business would need to find £258k of cash to pay out to the daughters, because more than 2/5 of his net worth is in the business. John and Tim are worried about whether the business could survive the cash hit in this scenario.

- John started the year with a negative Directors Loan Account (DLA) – in other words he has unwittingly taken money out of the business that had not been taxed and was not his to take. In the first 6 months of the year, this has deepened. If he does not pay back the overdrawn £82k from the start of the year, the company will have to pay an extra tax charge of £27k on top of their Corpration Tax bill in September – highly undesirable for the sake of a bit of planning.

- The Shareholders Agreement states that 6% interest is paid to or by the directors depending on their loan accounts. Because John has a negative DLA, he is paying interest which he is not happy about.

- John and Tim have identical business income in the 6 months – £50k dividends and £6k salary. John has higher living expenses and is drawing out twice as much as Tim though. Tim is not worried about drawing out less than John because he can see the benefit of earning a good rate of interest on his increasing DLA, and he knows that he will need to draw the cash in 3 years when he plans to do an extension on his house.

- However, Tim is very frustrated that John is presenting such a risk to the business by drawing out more than has been allocated to him as income. John can’t understand what the DLA situation is all about. His understanding has always been that he has a 25% share in the business, so thinks his business equity must be £191k (25% of the Retained Profits and Shares shown on the Balance Sheet).

- A dividend of £200k has been declared and split out according to the shareholding percentages. John and Tim are feeling sore that Phil is getting such a big dividend when he only works 2 hours a day in the business. Phil agrees but the accountant says the company articles of association do not allow anything else. They have lost confidence in the accountant and decided to get advice from elsewhere on how they can rectify the situation.

What can we get from all of this?

This simple statement brings clarity to the family and business financial position and exposes issues that would otherwise be buried. All these issues are resolvable, but if not known about would eventually come to light when it is too late to do anything about it. Not only would it be financially damaging, it could cause major harm to family relationships through misunderstanding and ignorance.

At UBTA we provide our clients with monthly Equity Statements included with their management accounts. Here are 3 compelling reasons for a regular review of equity split:

1) Personal Financial Planning – Tim is managing his drawings to maximise income and prepare for major personal expense in a few years’ time. John has done no planning and both he and the business will be suffering the consequences if he does not take action.

2) Family Financial Planning – Phil needs

to think about how his estate is handed down. He could leave his sons with a

significant financial crisis in the business if he does not restructure his

equity.

3) Personal Relationships – Most of these issues have the potential to cause serious breakdown in relationships. For the preservation of the family and the business, it is far better that everything is on the table and resolutions can be found.

4) Personal and Business Tax Planning – Phil needs Inheritance tax planning; John needs a plan to clear his DLA and avoid the extra tax charge.

As with other financial statements, an

Equity Statement brings clarity and provides a basis for future planning. We

strongly recommend it as a part of your suite of regular management financial

reports.