• You work through a limited company

• You are a director and the main shareholder of the company

• You manage the limited company funds and bank account

• You provide professional services to clients via your limited company.

There can be several benefits to a worker by doing this:

• You can tax plan, which can help ensure your tax efficiency

• You benefit from limited liability, which means your personal assets are never at risk

• You have full control over your business and its financial affairs

• You can claim tax deductions for a wide range of business expenses.

This can be attractive to employers as they will make significant savings, due to the absence of Employer’s National Insurance contributions. They also don’t have to offer employee benefits and rights, such as holiday pay, parental leave, and sick pay.

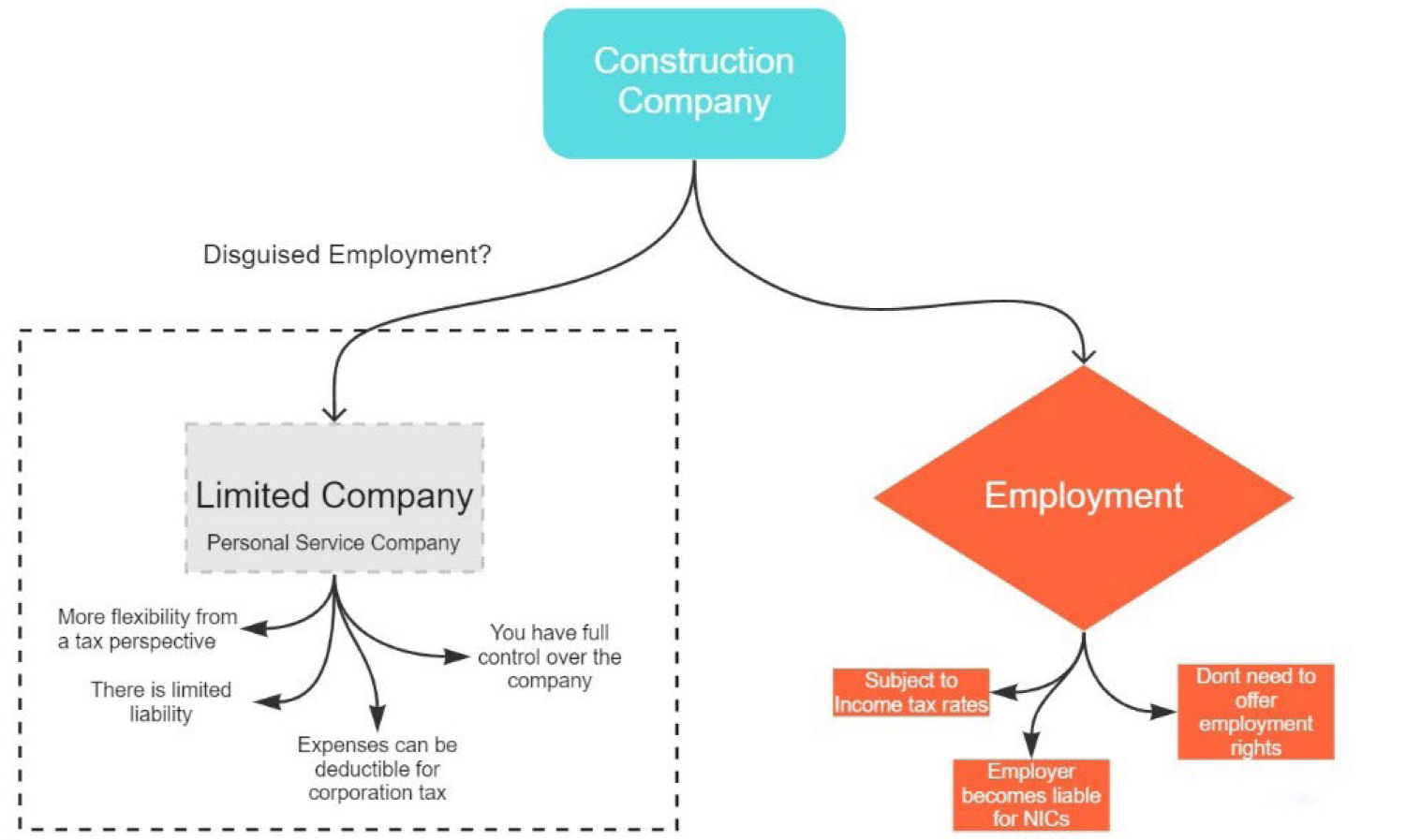

The differences between employment and operating a PSC are contrasted in the construction example below.

How do I know if I’m in disguised employment?

A disguised employee is a contractor whose limited company is engaged on a contract for services – however the contractor is being treated for tax as though they are an employee of the Construction Company.

It isn’t always clear if the arrangement is disguised employment and is often a matter of using judgement and considering a wide range of factors. However, there are 3 key questions you can ask to help provide some direction.

1. Am I under the control of the employer?

This is one of the most important tests to determine disguised employment. In an employment relationship, the employer has much greater control over the worker. Some specifics to consider are as follows:

• Do I report into a manager or supervisor?

• Does the employer specify the location for the services to be carried out from?

• Does the employer provide set working hours? A true contractor would arrange their hours to suit the task and fit around their existing schedule

• Who decides how to go about doing the task?

2. Am I allowed to send someone instead of myself?

A true contractor could send a suitably qualified replacement or substitute to complete the work. Personal service is a strong indicator of employment; if the end hirer is engaging you personally rather than your business this will suggest an employment relationship.

3. Do the employer and I have mutual obligations to each other?

In an employment relationship a company is obliged to provide work, and the worker is obliged to accept and complete this work.

How much is the extra tax I will have to pay if I’m caught out by IR35?

Once there is substantial evidence that the PSC is caught by the IR35 rules, a deemed salary payment will need to be calculated at the end of the tax year. This is a detailed calculation which effectively ensures the total amount of tax paid would be the same as if the worker had been employed.

It takes into account the amount received from the employer, allowable expenses incurred during the course of the employment, taxes paid by the PSC, pension contributions and how much of a salary has actually been paid by the PSC to the worker.

What action should I take?

If you operate a PSC, steps can be taken to reduce exposure to the IR35 rules. Watch out for contracts based on time and extended notice periods, which suggests a provision of work for a fixed length of time. Preferably an independent business should receive payment for completing a project, and when this project is completed, the contract genuinely comes to an end.

If you’re unsure, seek advice on whether you are in disguised employment and engage a tax adviser to ensure you have appropriate tax compliance in place.

As an employer, it may be worth alerting anyone who is likely to fall into the remit of the IR35 rules to protect them from unexpected tax liabilities in the future.