Are you looking to retain key members of staff, attract potential to your business or motivate currently employed staff? To ensure the long-term success of your company, employee share options can be added to your remuneration package for key management staff.

One of the most common concerns in talent retention is the attractive packages offered in the recruitment market. These can incentivise employees to leave as they have no long term commitment to your company. One way to make your offering more attractive to current staff and potential employees is to offer employee share options as part of a remuneration package.

Concept

As an employer in a community SME, you will likely have a stake in the company in the form of a shareholding. As you increase and improve measures such as Revenue, EBITDA, internal structure, etc. you will find your shareholding increasing in value. This drives you to improve and increase these measures as you are building up the future gains in the value of your share. Your share in your business is what drives you to stay committed as an owner-manager.

When considering if an employee share option would be beneficial to offer to then employer and employees there are multiple things to bear in mind:

Benefits

- Balancing out lower salaries – If you have employees on low basic rates, you can pay them dividends to increase the income they receive.

- Easing pressure on cashflow – A salary must be paid under the employment contract; however, dividends have no obligation. Dividends can be declared and paid as and when the business decides to, e.g., when the cash reserves are more than the company needs.

- Attracting and retaining talent, motivating employees to become more productive – The promise of an increase in wealth is always attractive. With shares, the success of the employee directly reflects in the increase in share price.

- Remunerating employees in a tax-efficient way – Dividends are liable to lower tax rates than normal salaries and they aren’t subject to NICs.

- Long term benefits – An employee must stay at the company they must remain at the company for an extended period in order to exercise their share options. This not only benefits the company, but also allows the employee to have greater integration within the business.

Pitfalls

- Setup and ongoing costs – Legal and professional costs may be significant when setting up an employee share option, there are also ongoing costs involved e.g., issue of new shares and dividends. However, the cost of this is often less than losing the key staff.

- Dilution of Share ownership – Selling shares to employees may reduce your percentage shareholding within the business, giving you less of a lever within the business. You may also lose control. However, this can be mitigated by offering share options that are dividend only.

- Disconnect in financial expectations – Many employees may not necessarily understand the risks involved with their purchase, e.g., they are not guaranteed a dividend and the value of the shares could fall. Again, this issue can be mitigated by committing to a minimum dividend stated within the shareholders agreement.

Application

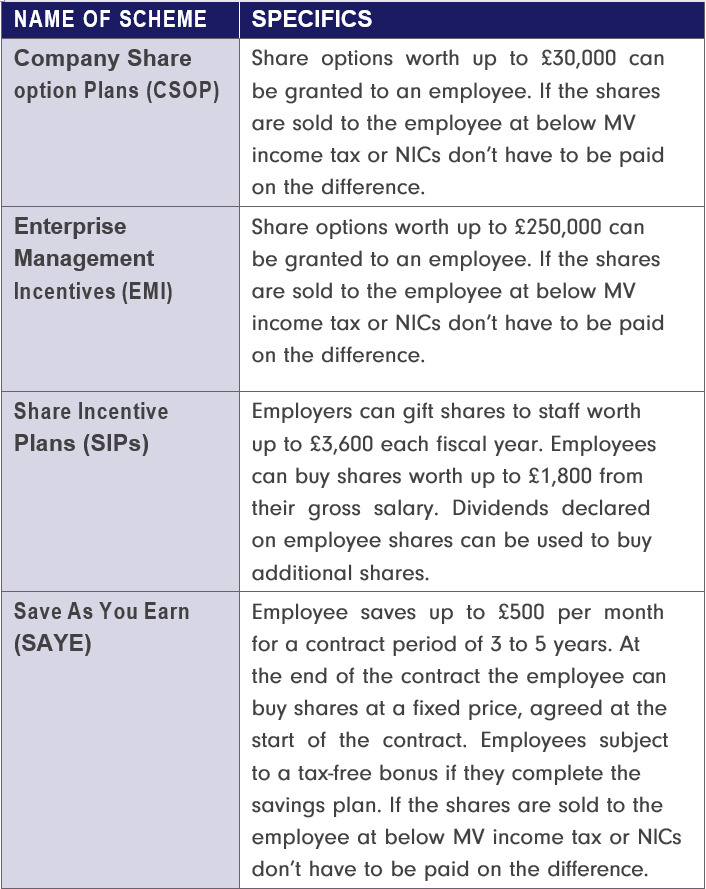

When deciding to provide a share option it is important to understand the specifics to each scheme. Employee share schemes are split into two categories: tax advantaged and non-tax advantaged.

Tax advantaged

These are schemes that are approved and recognised by HMRC. They generally provide very good tax incentives such as being exempt from income tax or capital gains tax. However, they generally offer less flexibility in terms of maximum share offering and contract periods.

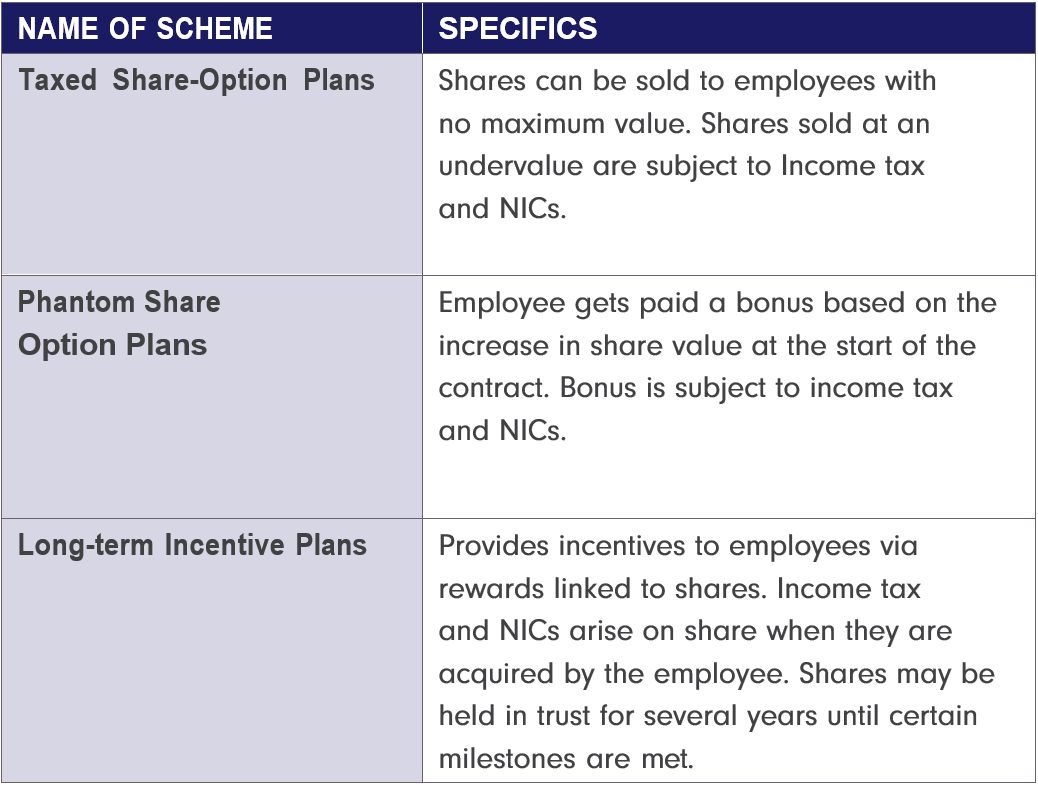

Non-Tax advantaged

These are schemes that are not approved and

recognised by HMRC.

They are generally liable to Income Tax, NICs under the PAYE system. There is greater flexibility with these schemes as the conditions are much less stringent.

If you would like further advice, please

get in touch with us at [email protected]