Why is this happening now?

With the economy still reeling from the whirlwind of a global pandemic resulting in a national debt of over £2 trillion, taxes are ticking up to pay for an ambitious plan to improve health and social care.

The main increase in tax rates this year is the National Insurance Contributions (NICs) increase. From April 2023 this will be siphoned off from NICs and a completely new tax called the Health & Social Care Levy will be introduced which will be specifically ring-fenced for expenditure on health and social care services. At this point, National Insurance rates will reduce to current levels but all the increases will stay in place through the new Levy.

For decades health services have been provided free at point of use through the NHS, but social care costs have continued to spiral upwards. With an aging population this has been a growing problem and the government has taken this step to ensure that older people have their costs limited.

Only those with assets of more than £100,000 will have to pay for social care, those with lower value estates will have means tested state support. The maximum anyone will have to pay in their lifetime for social care will be £86,000.

How much will I have to pay?

National insurance contributions (NICs) and some income taxes are going to increase from April 2022 by 1.25% across all levels of income apart from those currently paying 0%. The taxes affected by the proposals are as follows:

1. Class 1 primary NICs – paid by employees

on their salaries

2. Class 1 secondary NICs – paid by

employers on salaries paid to employees

3. Class 4 NICs – paid by partners and sole

traders on profits

4. Income tax on dividends – paid by

shareholders of a company on dividends from a company.

Tax on rental income and other income tax, Class 2 and Class 3 NICs are not affected.

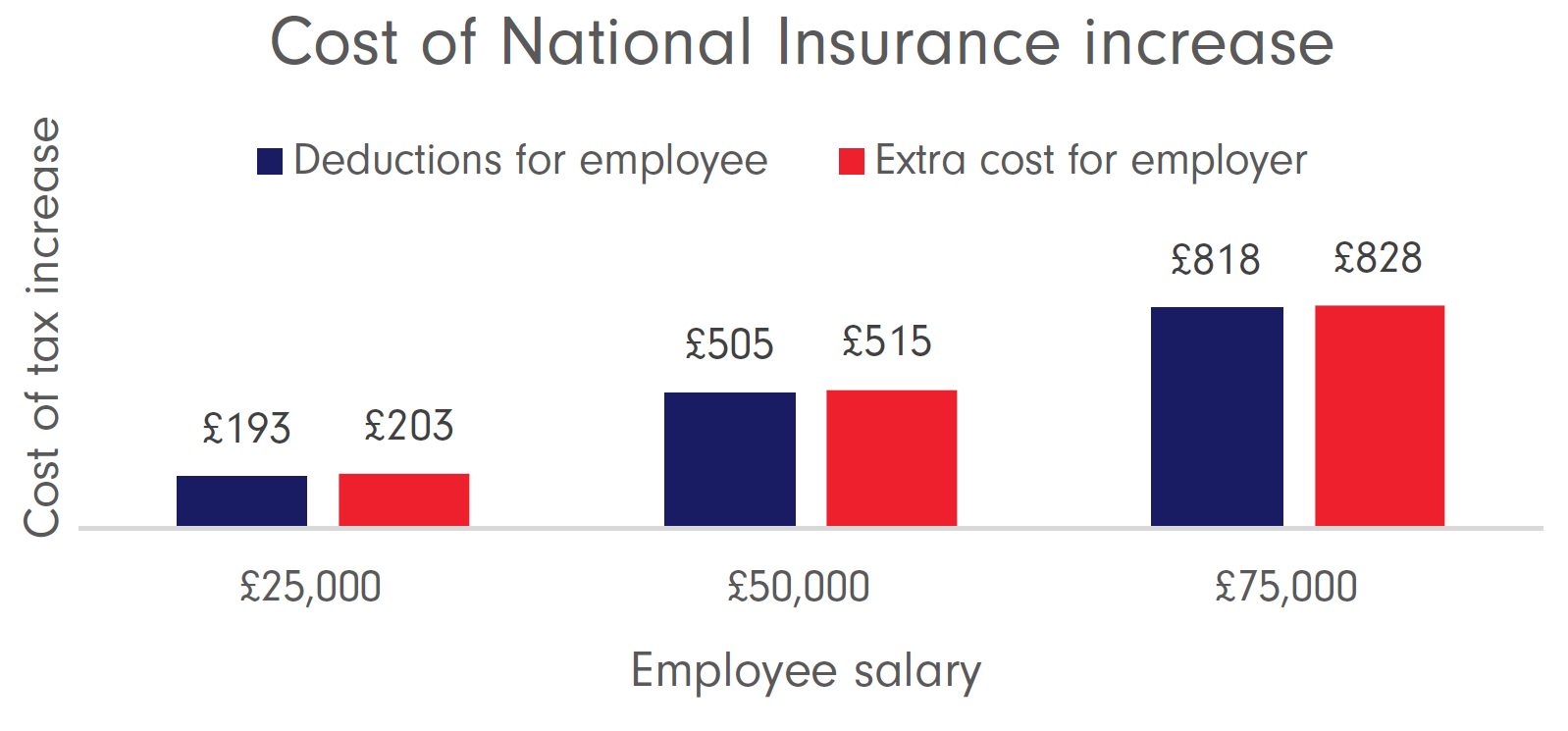

By way of example, this means a couple

earning a salary of £12,000 per annum and dividends of £38,000 each will both

pay an extra £480 each per annum. A range of salaries outline below show the

extra cost for the employee and the employer.