A peculiar economic environment has exaggerated the growth headache. This economic environment has been

largely driven by a cocktail of global events – the back end, hopefully, of the Covid-19 crisis, and the beginning of

the conflict in Ukraine.

With inflation continuing its rise to 6.2% in February 2022 from 5.5% in January 2022, businesses are facing a quandary as

to whether they should stock up to beat rising prices or potential supply shortages, and further jeopardise their often-weak

cash position, or whether they should preserve cash and miss out on potential revenue through not having stock on hand. This is

particularly relevant with some businesses finding sales easy to come by.

As inflation continues to rise, we are all waiting further increases in interest rates. This increases the risk associated with high gearing and

funding growth through debt capital. In this article, we take a brief look at the factors which impact how fast your business can afford to

grow without turning to external funding.

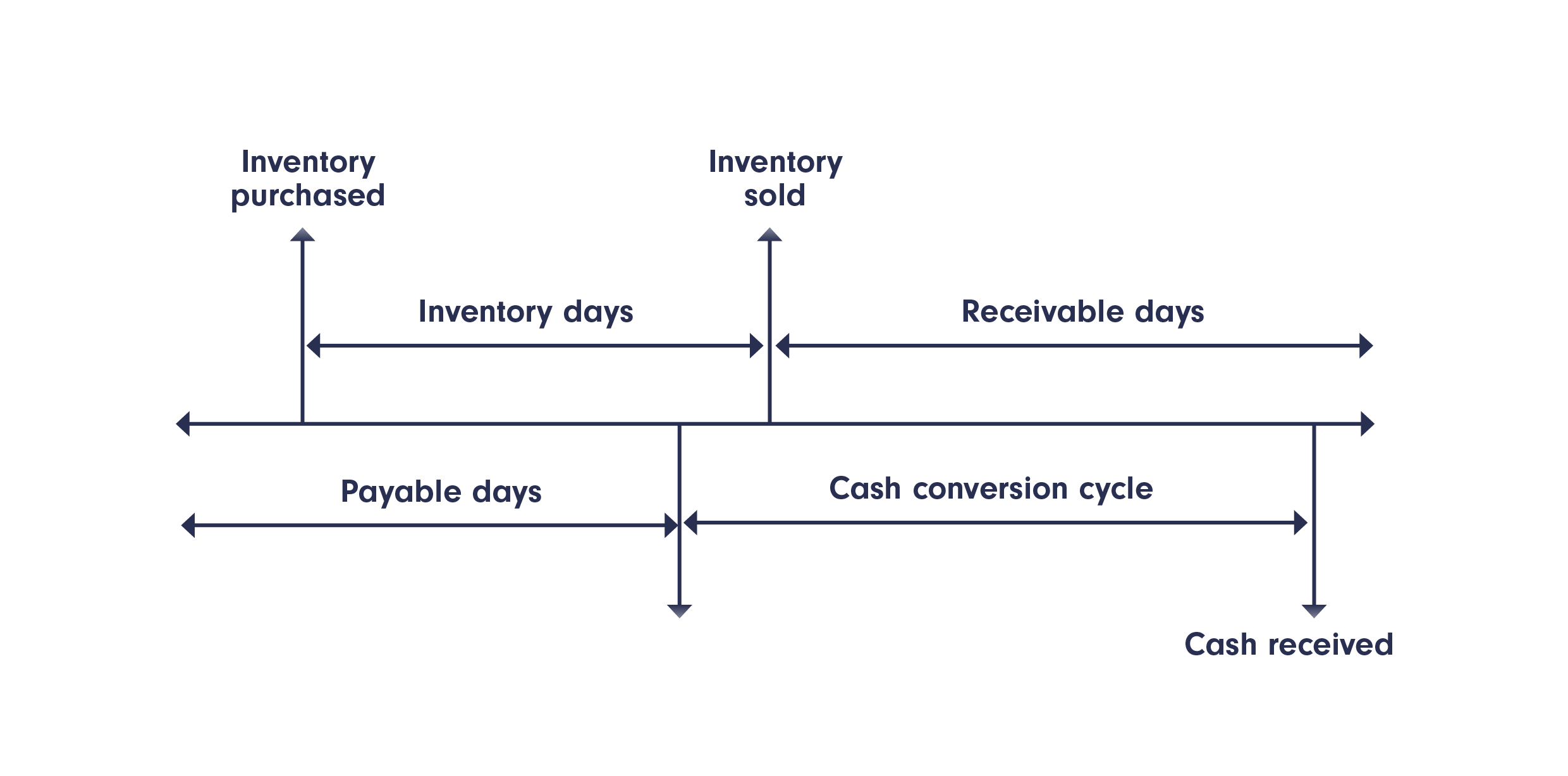

Cash conversion cycle

Your cash conversion cycle is the number of days between paying your suppliers and receiving money from the sales that you make.

This can be calculated by taking your receivable days + inventory days – payable days.

The shorter your cash conversion cycle, the more cash flow positive your business is going to be.

Consider whether you can shorten your cash conversion cycle by:

- Seeking better terms from your creditors

- Reducing terms of your customers, or collecting deposits where possible

- Reducing your stockholding, or sending stock direct-to-customer where possible.

Amount of cash required for each £ of sales

Having ascertained the cash conversion cycle of a business, we can work out the cash required for each £ of sales.

In a traditional buy-sell business, each £ of sales comes with a reasonably predictable cost. Say a business operates at 40% gross profit margins, then each £ of sales is going to cost it 60p. Using this knowledge of how much each £ of sales costs, combined with a knowledge of the businesses cash conversion cycle, we can figure how much cash is needed for each £ of sale. Consider whether you can reduce the amount of cash required for each £ of sales by:

- Improving your cash conversion cycle

- Increasing your gross profit margin.

Amount of cash generated for each £ of sales

As well as the cash required for each £ of sales, it should generate cash with each sale it makes – that is, the profit made on each £ of sales. Consider whether you can increase the cash generated by each £ of sales by:

- Increasing your gross profit margin

- Cutting back overheads to increase net profit.

The gap between the amount of cash required for each £ of sales and amount of cash generated by each £ of sales is your cash headroom. This is what determines how fast your business can afford to grow without seeking capital outside of retained earnings, if it can afford to at all.

Applying your business numbers to the three items above, you can calculate your self-financeable growth rate (SFG) i.e., the rate you can grow without requiring external funding. Whilst the factors above are straightforward for a traditional buy-sell business model, more complex modelling may be required for other types of business models such as a project business.